- TruStage business resources

- Insights & trends

- Understanding customers

- Portrait of life insurance customer

Portrait of today's life insurance customer

For too long, several groups — from Black, Indigenous and People of Color (BIPOC) to Gen Z — have been left out of the conversation when it comes to financial services and wealth building. Stubborn stereotypes and unconscious biases have kept the industry from connecting with consumers on several financial fronts, not the least of which is life insurance.

For life insurance distributors, this means sizable pockets of opportunity for deeper customer engagement may be hiding in plain sight.

TruStage® has been on a journey to learn as much as we can about consumers through a multicultural and multigenerational lens. This is not only for us and our life insurance distribution partners; it’s ultimately for the people we collectively serve. By positioning ourselves as learners and consumers as teachers, we are enriching industry knowledge of tomorrow’s policyholders.

Black consumers’ most rising financial worries center on family

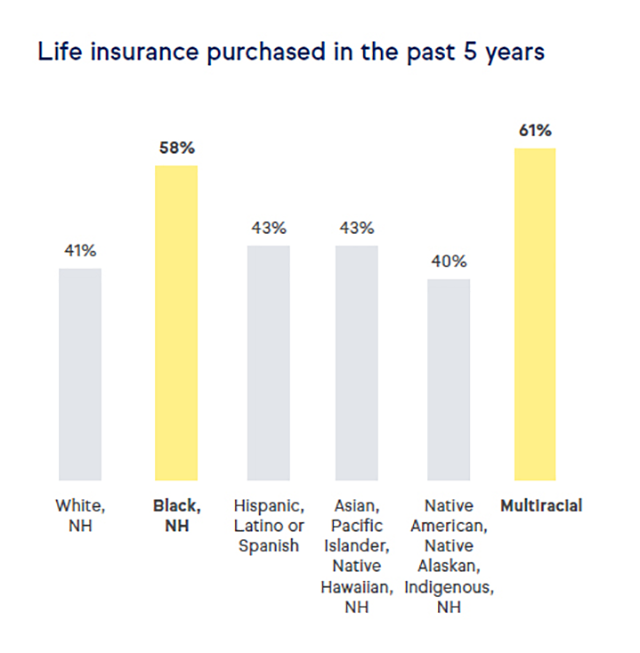

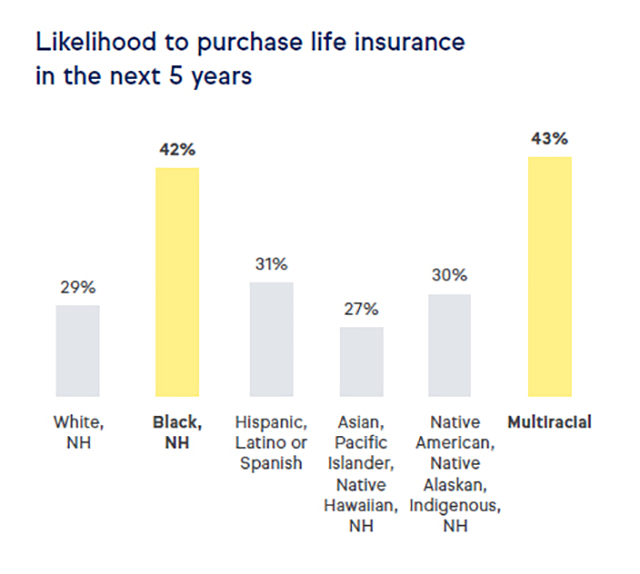

According to TruStage’s What Matters Now™ multicultural and multigenerational research, Black and Multiracial consumers were the most likely to have purchased life insurance in the last five years. They were also the most likely to purchase life insurance within the next five years.1

This is perhaps not surprising given that Black consumers’ most rising anxieties centered on the financial needs of family members. Black survey respondents’ three worries with the highest increase from 2017 to 2022 were saving enough for children’s college education, having money to take care of a parent or loved one and having money to take care of children.1

Just 40% of Gen Z consumers own a life insurance policy

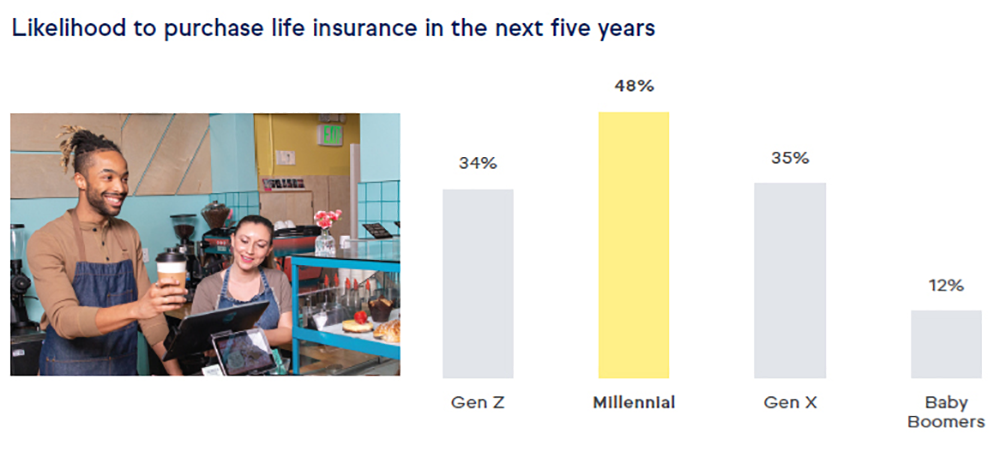

Generationally speaking, Millennial consumers were the most likely among the TruStage What Matters Now survey participant groups to purchase life insurance in the next five years. However, among Gen Z respondents, a full 34% were looking for a policy in the same timeframe.1 Combine that insight with the LIMRA finding that just 40% of Gen Z consumers say they own a life insurance policy2, and the opportunity for life insurance distributors to help more of their young customers attain coverage for their families becomes clear.

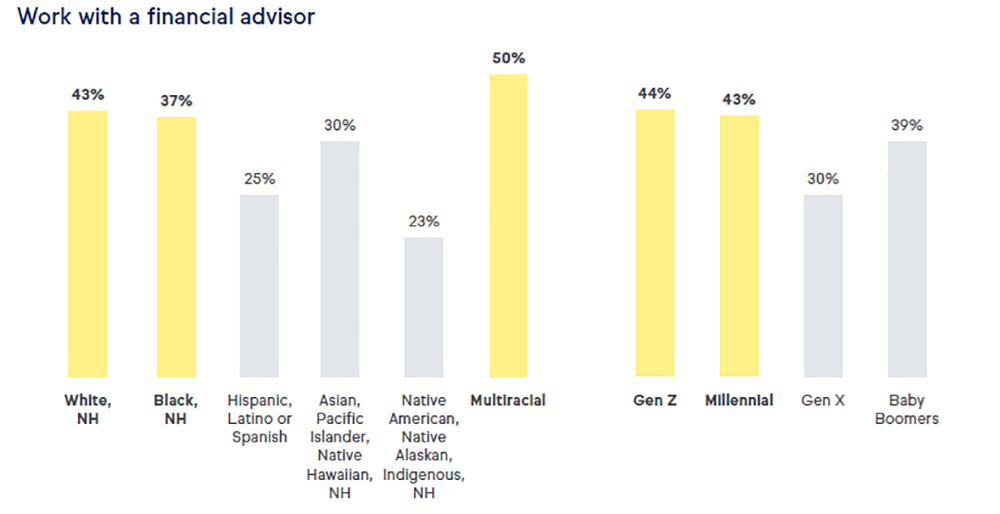

Gen Z consumers are a growing part of our workforce — they are parents, caregivers, heading and contributing to households financially and are an important consumer segment for life insurance distributors to consider both now and for the future. Notably, 44 percent of the Gen Zers who participated in the TruStage research said they are working with a financial advisor1, indicating a significant demand for financial guidance.

A brighter financial future should be accessible to everyone. We can only achieve that by evolving our understanding of all consumers’ lives, hopes, dreams and finances — and especially those historically left behind by mainstream financial services. With greater knowledge and deeper empathy, life insurance distributors will be much better equipped to connect BIPOC, Gen Z and other consumers with the financial products they need to feel confident in their families’ financial futures.

Trust TruStage to help find & engage pockets of opportunity

TruStage thought leaders know it takes customizable, well-tailored solutions and service to strengthen customer relationships. Contact us to learn how we can help your organization find and engage the pockets of opportunity that exist within your customer and prospect bases.

When we connect, we’ll talk about making life insurance even more attainable by eliminating most obstacles in the buying journey. This includes initiatives like our 10-minute, embedded insurance experience, which enables consumers at all stages of life to make speedy, yet fully informed, decisions for the right coverage.

Our aim is to make life insurance accessible to all. We are actively looking for partners who share our belief that a brighter financial future is possible for everyone. Contact our team to learn more.