- TruStage business resources

- Insights & trends

- Financial trends

- Banks and life insurance

Grow your business with life insurance

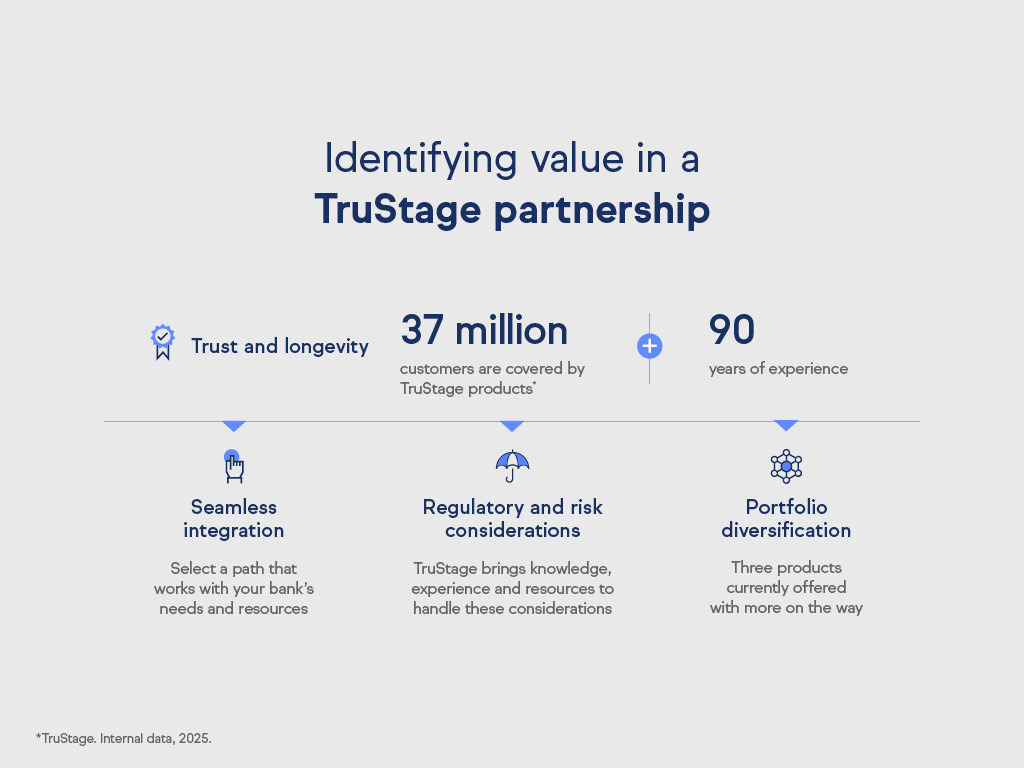

Growing your business and expanding revenue beyond lending and fees is a consistent, if not ever-growing, challenge you face. Coupled with the increased demand for visibility in a cluttered marketplace, finding solutions that fit seamlessly for you and your consumers is of utmost importance. Through partnerships, additional products and services such as life insurance could bring the growth you're looking for while filling the needs of the consumers you value. That partner could be TruStage — offering decades of experience and robust technology investments.

The benefits of selling life insurance

Adding life insurance to your products and services could pay off both financially and with prolonged customer loyalty. Banks that sell life insurance may realize increased revenue through life insurance commissions and premiums. You may also boost customer retention through bundled services. And there are potential tax advantages benefiting banks that offer life insurance. So how do you go about selling in a careful, efficient and significant way?

How to implement life insurance

Banks with experience in this area understand the need to leverage the most innovative life insurance products, utilize technological advancements and find solutions to meet the ever-evolving needs of consumers. There are also compliance issues to navigate both with regulatory compliance and the safekeeping of customers' financial information. Choosing a partner with 90 years of experience* is key to potential success.

How banks can market life insurance products

Building awareness is vital. Begin with an educated workforce who can talk about various life insurance policy types, simply and thoroughly. Add in digital marketing to reach a broader — and often younger — audience since younger consumers have the potential to remain loyal longer. Use cross-selling to promote life insurance along with the other financial products you offer. When customers increase the number of ties they have to your business, they tend to stick with you. And most importantly, don't do it alone. Identify a partner with insurance experience and built-in systems you can adopt, integrate and utilize.

Integrating life insurance with a solid partnership

Take steps to eliminate the difficult and often expensive task of a new partner integration by selecting a path that fits with your needs and capabilities. TruStage has the ability to enter into partnerships with a variety of prebuilt systems, ready to implement and work with your resources.

TruStage has developed three different integration experiences for partners: Simple path, Application path or Full Integration path. You can select the option that works best for your needs. Each one provides a different level of control and involvement, depending on what is needed for your customers. Adoption is developed to be simple; the work has been done. No new systems required. That means a simple application process with only a few questions and a quick response time in most cases — a benefit customers appreciate and enjoy.

Why partner with TruStage?

When you choose Life Distribution from TruStage, you'll find three life insurance choices available to fit almost any client's needs at any stage of life. Each differs in the amount of coverage, issue age and underwriting, while all involve a simple application process. The choices are:

- Simplified Issue Term Band

- TruStage® Advantage Whole Life

- Guaranteed Acceptance Whole Life

You have options to choose from to help provide the coverage that could best fit your customers' needs, budget and lifestyle.

Adding insurance sales in the digital age is a strategic move that is meant to drive sustainable growth, improve market resilience and offer a full range of products to your customers, building loyalty and trust. If you're interested in making TruStage your life insurance partner, let's talk.

Want to learn more?

Take the next step.