Quick end-to-end deposit openings

Our Digital Storefront helps you offer streamlined experiences and speed up the personalized deposit opening process, then follow through by supporting the member journey all the way to the end, including funding. As a result, it helps balance your lending and deposits portfolio. And because it saves time for the staff, your organization saves money.

More flexibility across a broad range of deposit products

The Digital Storefront helps drive new customer deposits by letting you experiment and measure different product configurations using a convenient admin portal designed for ease of use.

- Share Certificate

- Savings

- Money Market

Improving your deposit services helps you improve their financial lives

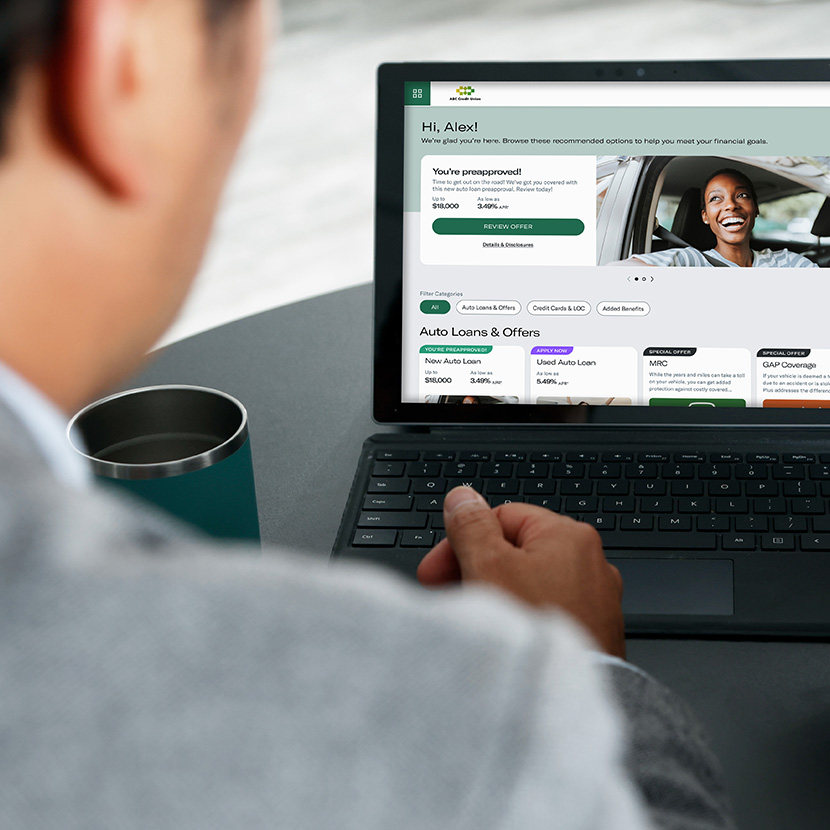

Consumers will have access to your organization’s comprehensive portfolio of reliable deposit products and robust services using our targeted storefront that can reach members during online banking visits. It’s one of the many reasons our deposits channel is so uniquely equipped to help grow your organization by helping you grow non-interest income.

Designed to be streamlined and simple to implement

Enable your customers to open CDs and savings accounts in under two minutes.

Proven in the market

In just 24 days, one client generated 517 new certificates and over $3.04 million in deposits.1

Integrated payment solutions

Guide customers through the entire funding of new deposit accounts with payment authentication from verification partners to enhance the flow and minimize risk for your organization.